maryland digital ad tax effective date

Maryland Senate Bill SB 787 became law 30 days after being presented to the governor who allowed the bill to pass without his signature. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021.

Identification Taxability Of Digital Products

The biggest exception so far has been the first-in-the-nation Maryland digital advertising tax.

. The tax is imposed on entities with global annual gross. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. April 12 2021 928 PM.

Taxability now includes certain. Maryland Delays Effective Date of Pioneering Digital Ad Tax. A bill that would amend the Maryland Digital Advertising.

Digital Advertising Gross Revenues Tax ulletin TTY. This amendment would not delay the effective date of the tax it only changes the applicable tax year 2021 to 2022. Even though the legislation says the tax is effective July 1 2020 under the Maryland Constitution vetoed legislation becomes effective the later of the effective.

On 12 February 2021 the Maryland legislature overrode Maryland Governor Larry Hogans veto of legislation HB 732 that imposes a new tax on digital advertising. Marylands legislature on February 12 2021 voted to override the governors veto of legislation imposing a new tax on. On April 12 2021 Maryland legislators passed Senate Bill 787 which proposed several significant amendments to Marylands digital ad tax.

Maryland enacts tax on digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates. The potential pitfalls of Marylands proposed digital advertising tax are numerous and the novelty of the proposal means that tax policy experts are still grappling with its. The tax will apply to companies that make at least 100 million in global revenue and at least 1 million in digital ad revenue in Maryland.

Enacted Maryland House Bill 932 has expanded the application of sales and use tax to digital codes and products effective March 14 2021. Many FY 2021 budgets do not include most prior policy plans. Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country.

The state Senate Monday overwhelmingly passed SB. The new tax had been. The second bill HB.

Effective date in the previously vetoed. A constitutional challenge to Marylands digital ad tax by Comcast and Verizon will advance after a state court judge largely denied the states motion to dismiss the case. The Maryland Department of.

787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue. Most notably Senate Bill 787. The statutory references contained in this publication are not.

787 delays Marylands digital advertising. Tax on digital advertising services is enacted. The effective date subsequently was delayed from 2021 until 2022.

732 establishes a new digital advertising gross revenue tax the first in any state. Big Tech Challenges Marylands Pioneering Digital Ad Tax. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980.

Maryland State Tax Updates Withum

Maryland Refundwhere S My Refund Maryland H R Block

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

The Myth Of Normal Trauma Illness And Healing In A Toxic Culture Mate Md Gabor Mate Daniel 9780593083888 Amazon Com Books

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Indirect Tax Kpmg United States

View All Hr Employment Solutions Blogs Workforce Wise Blog

Cost Council On State Taxation

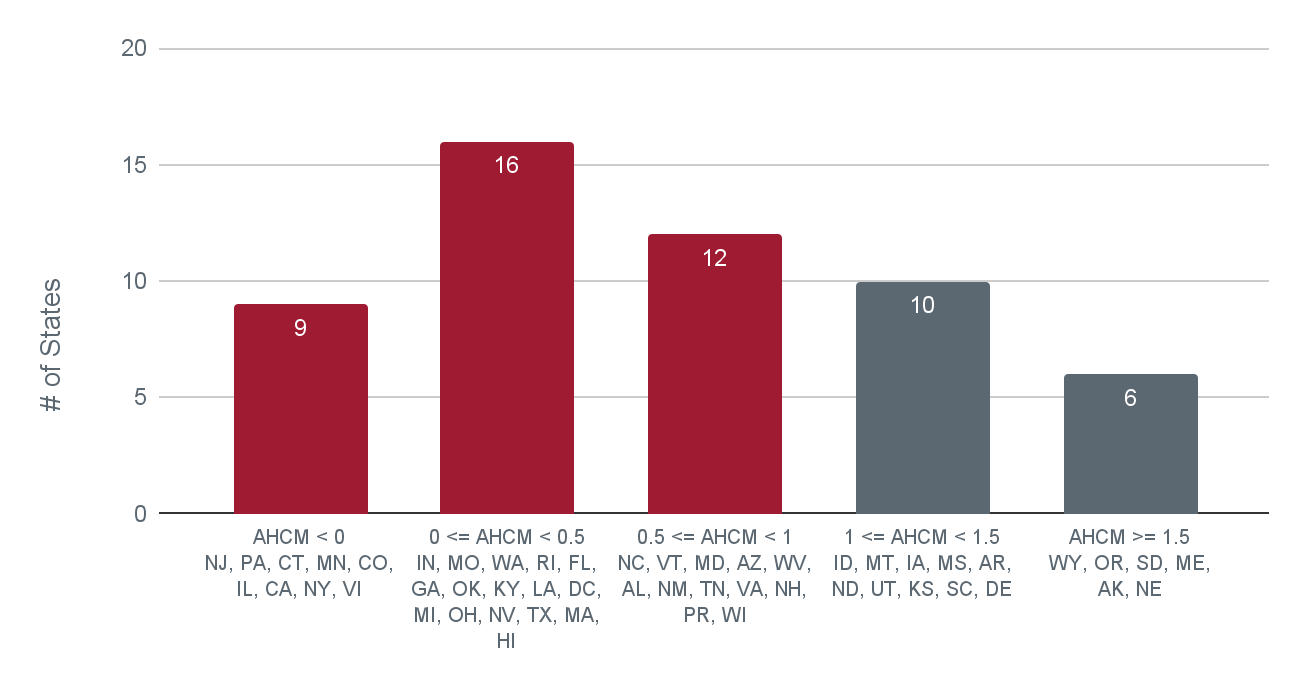

State By State Guide To Economic Nexus Laws

Amazon Facebook Google Back Lawsuit Against Maryland S New Online Ad Tax The Washington Post

Maryland Delays Effective Date Of Pioneering Digital Ad Tax

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland S Digital Advertising Tax Is Unworkably Vague

Maryland Enacts Nation S First Digital Advertising Tax With Strict Penalties For Noncompliance Subject To Immediate Challenges Thought Leadership Baker Botts

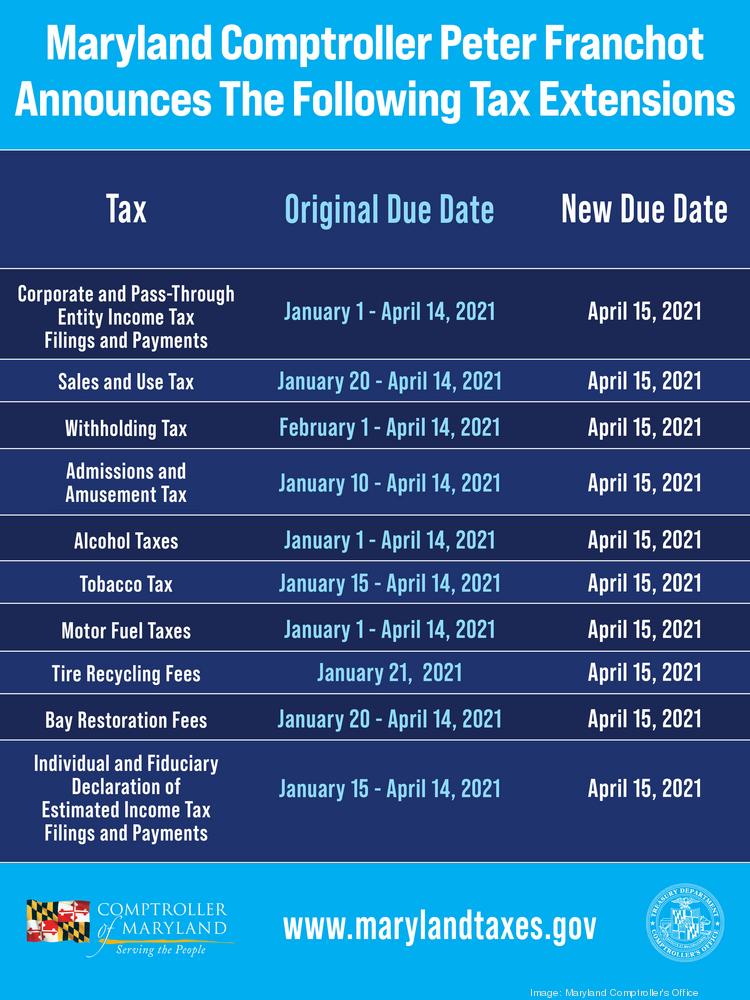

Maryland Comptroller Peter Franchot Delays Business Tax Payments For 90 Days Baltimore Business Journal

The Lancet And Financial Times Commission On Governing Health Futures 2030 Growing Up In A Digital World The Lancet

Maryland Department Of Information Technology Marylanddoit Twitter