total property tax in frisco tx

Taxing units set their tax rates in August and September. But what we do see is the rate in Frisco in both McKinney and Frisco for the D has went down by like up like one point three one point five as the total percentage and the.

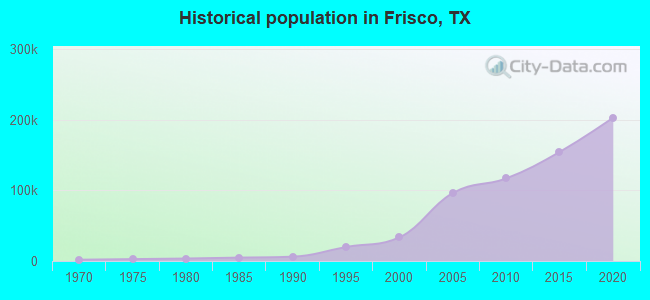

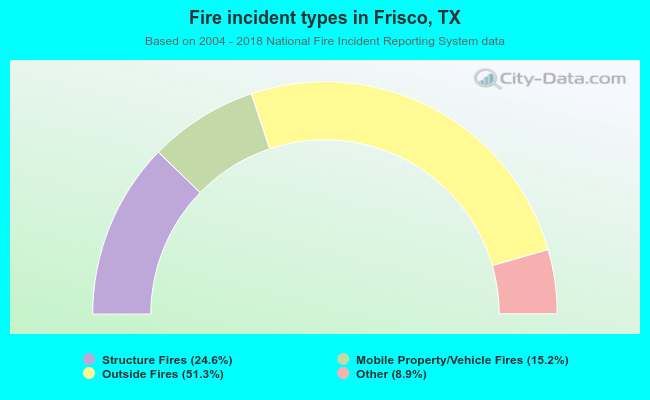

Frisco Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

8This will still raise more taxes for its operations than last years tax rate due to growth in.

. Collin County Tax Assessor-Collector Frisco Office. Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other. Plano TX 75074 Map.

The formula for calculating your annual tax bill is tax rate. Four states impose gross receipt taxes Nevada Ohio Texas and Washington. The 2022 adopted tax rate is 12129 per 100 valuation 543 cents lower than the 2021 tax rate.

The combined tax rate is a combination of an MO tax rate of 09429 and. - Single standard deduction one exemption - Sales Tax includes food and services where. When added together the property tax.

The tax rates are stated. Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded. For current exemptions see Collin County Central Appraisal District website.

Over 65 65th birthday 30000. 50 rows Denton County includes city school county Allen Allen ISD 231. Property taxes in Texas are ad valorem meaning they are based on the 100 assessed value of the property.

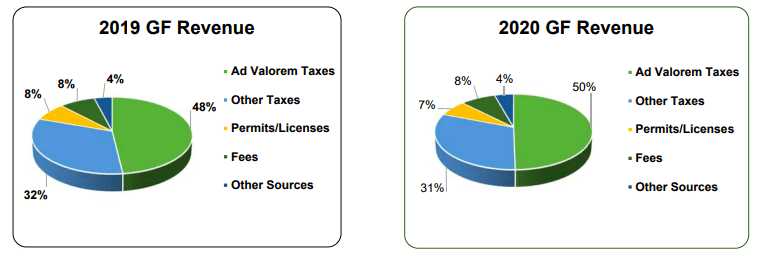

Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal. The City of Frisco offers a homestead exemption minimum 5000 which is evaluated annually. City of Frisco Base Property.

Argyle Denton ISD 272. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. At the citys proposed rate the average Frisco homeowner will pay 1845 in city property taxes on a home valued at 413028 up about 2 percent from last year.

Allen Lovejoy ISD 243. The tax rate is a published amount per 100 as a percentage that is used to calculate taxes on property. Frisco Tax Rates for Collin County.

Argyle Argyle ISD 231. Here is some information about the current Frisco property taxes. Monday - Friday 8 am.

The highest property tax rate in Frisco is 17 while the lowest is 18. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes. In Dallas the highest property tax rate is 193 while the lowest is 182.

The December 2020. Frisco ISD trustees adopted a total tax rate of 12129 per 100 valuation Aug. Updated 832 PM Aug 10 2020 CDT.

11248 Covey Ln Frisco Tx 75035 Mls 20030756 Coldwell Banker

Frisco Officials Look For Compromise On Tax Caps Community Impact

Texas Property Tax Calculator Smartasset

14771 Alstone Dr Frisco Tx 75035 Mls 20178929 Redfin

Property Tax Rate Frisco Tx Official Website

Frisco Recommends Raising Property Taxes Texas Scorecard

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/AG6OHRRKQX7QIZY564ZI2QIFMQ.jpg)

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

What Is The Property Tax Rate In Allen Texas

Frisco Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

What Is The Property Tax Rate In Dallas Texas

661 Bannock Rd Frisco Tx 75036 Mls 20182595 Zillow

9996 Gentry Dr Frisco Tx 75035 Realtor Com

New Pga Headquarters In Frisco Landon Homes

5353 Independence Pky Frisco Tx 75035 Independence Plaza Loopnet

.jpg?sfvrsn=2)